There are many ways to avoid paying interest on your credit card debt. There are also instances when you can avoid paying interest even if you do not pay it off every month. You may be able to avoid interest on credit card by canceling your credit card, moving your debt to another credit card, or transferring debt to another lender.

Table of Contents

What’s Wrong With Paying Interest?

When you pay interest on a credit card balance, you end up paying more for your purchases than you borrowed in the first place. The higher your interest rate and the longer it takes you to pay off your balance, the more interest you will pay overall. Some credit cards charge interest daily, so a credit card that states an APR of 15% will actually end up costing you more than that if you do not pay off your credit card balance each month.

For some people, that’s lunch money for a week, a tank of gas, a month of cellular service, a college textbook, or a month’s worth of diapers. You don’t realize how much you’re actually spending on interest because it’s spread over a period of time and lumped in with your credit card payment, but that doesn’t make it any less significant. It’s simple mathematics—decrease the amount of interest you pay and you’ll increase the amount of money you have available to spend on necessary expenses.

In Theory, Avoiding Interest Is Simple

Credit cards are convenient and can be a great tool. However, they can come with some stiff interest rates that could end up costing you hundreds or even thousands of dollars over time. You could certainly come up with a better way to spend that money, couldn’t you? Luckily, there are ways to avoid credit interest rates so you won’t be wasting your hard-earned money!

Pay the card’s full balance every pay period

This is the simplest, surefire way to avoid interest. After all, you can’t be charged interest if you have no balance! At the end of each pay period, which is usually 1 month, pay the full amount that you owe on the card. That way, you’ll accumulate precisely zero interest.

- The alternative is making partial or minimum payments. You’ll avoid late fees, but the interest will build up if you don’t get rid of the card’s full balance.

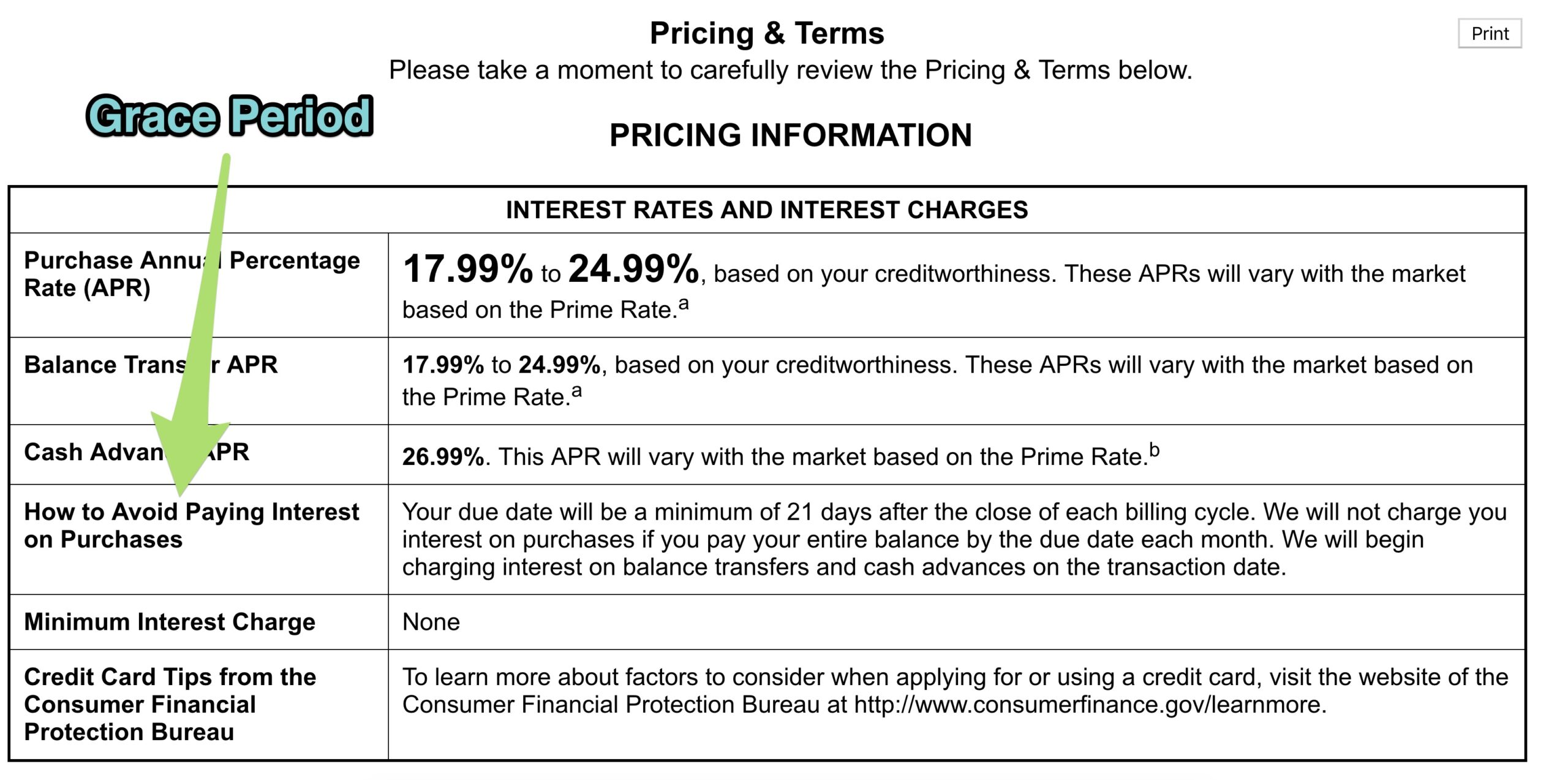

- In rare cases, a card might not have a grace period for payments, meaning you have to pay immediately to avoid interest. Always read the fine print on your card so you know how long the grace period is.

Take care of the bill after every purchase

This takes some discipline, but you will definitely avoid interest. It’s basically a more extreme method of keeping your balance at zero. As soon as a purchase shows up on your credit account, pay it right away. This is much easier with online banking, so you can just make a quick transfer to take care of the bill.

- You can set most cards to send you an alert when you make a purchase. This is a good reminder to send your payment in.

- You might also be able to set up an automatic transfer to pay every day to keep your balance at zero.

Keep track of your payment dates to avoid penalty fees

If you miss a payment, you’ll be hit with a penalty APR. This is a higher interest rate than your normal APR, and could last for as long as 6 months. The best way to avoid this is making sure you pay your bill on time every pay period. Stay on top of your bills to avoid any late fees or penalty interest.

- You could set up automatic payments to transfer the amount owed every pay period. This way, you won’t have to remember the payment date.

- Even if you can’t pay the bill in full, pay at least the minimum. You’ll accumulate some interest, but it’ll be a lot less than the penalty rate.

- If you do get a penalty APR and you have good credit, contact your credit issuer. You might be able to negotiate a lower APR or get the penalty waived if you have a good history.

Transfer your debt to a card with an introductory 0% APR

Some cards offer temporary interest-free credit when you sign up. This period is usually 12-18 months, but it depends on the card. You can then transfer any balances on other cards to this card and pay it off without worrying about interest.

- Remember that this introductory period will end eventually, and you could be hit with a high-interest payment if your balance isn’t paid off by then. If you can’t pay the card off during the introductory period, transfer the balance to another card that’s offering 0% APR.

- Use this as a last resort to take care of debt. If you open multiple cards in a short period, your credit rating will drop.

Get loans for large purchases instead of using your card

Putting large purchases on your card might run up interest payments. Cars, furniture, home repairs, and lots of other expensive items can end up costing you hundreds or thousands of dollars in accumulated interest. If you can, set up a payment plan with the seller or business instead of putting the purchase on your card. This circumvents the card and any interest you might have built up.

- Medical bills are a main example. They’re usually very expensive, but most medical billers are willing to work out a payment plan with you. That way, you can avoid putting anything on your card.

- Remember that these payment plans can have interest rates of their own. Don’t take out loans with interest rates that you can’t keep up with.

Request a lower interest rate if you have a good credit history

This won’t eliminate interest, but it could lower it significantly. Some credit agencies are willing to work with you if you have a good credit history with them. Call your credit provider and ask to have your APR lowered, in light of your good credit. This could lead to big savings if you use your card a lot.

- One negotiation tactic is to say you’ll cancel your card and go to another company that will work with you. The company will probably be willing to cut their own rate rather than lose your business entirely.

Find a new, low-interest card if you need to carry some debt

There are lots of credit card companies that want your business. Some of them offer lower interest rates than their competitors to attract customers. Shop around and see if any cards have lower rates than you’re currently paying. You could get a good deal as a new customer.

- Always read the fine print to see if this is the permanent APR or just an introductory rate. You don’t want to be caught off guard if the interest rate suddenly rises when the introductory period ends.

Avoid cash advances if you can

Cash advances allow you to withdraw cash from your line of credit. The catch is that the interest rates are very high, often well over 20%. Unless it’s an emergency and you need the cash, avoiding cash advances is best.

- If you’ll be able to pay off the advance within a few days, then you might be able to avoid the high fees. If not, then it’s best to skip them.

Follow a budget so you don’t accidentally overspend

It’s easy to overspend if you aren’t careful. That’s why drawing up and sticking to a budget is your best bet for avoiding debt and interest. Decide on a set amount you have to spend each month, then save the rest. That way, if there are any emergency or unexpected expenses, you can pay them off without relying on credit cards.

Conclusion

Thanks to credit cards, when we make purchases, we can make them with our own money instead of using cash. This makes it easy to spend more than what you actually have in your bank account or in your wallet. When interest-free credit cards appeared, they were great for helping consumers easily pay their bills with the option of paying the balance within the corresponding timeframe without having to worry about getting charged an excess fee or interest.