A gift tax is a form of tax assessed on money and property given by an individual (the giver) to recipients (gifts). A gift tax can usually be avoided with careful financial planning and legalities. Below we’ll discuss the different loopholes for avoiding gift taxes and what you can do to protect yourself from certain types of gift taxes.

In the United States, individuals are taxed for property transfers from one person to another for less than market value. There are many reasons to transfer property for free or for a reduced price, and understanding gift tax laws before you make the gift can help you reduce or avoid hefty taxes if possible. This article deals with gift tax laws in America, but keep in mind that laws in other countries will differ.

Table of Contents

Part 1 Understanding Gift Tax Law

Learn about gift tax law. Federal and state laws dictate how much property and/or assets one person can give to another (either free or at a reduced rate) without having to pay a fee in taxes. Keep in mind that very few Americans ever have to pay a gift tax, because very few are wealthy enough to give gifts that exceed the allowable limit and warrant taxing.

- The federal law governing gift tax is called the “unified federal gift and estate tax” and is governed by the Internal Revenue Service. The maximum federal gift and estate tax rate is currently 40%.

- State laws also apply to gift and estate taxes. Two states, Connecticut and Minnesota, have their own laws for gift taxes, so if you reside in one of these states, be sure to learn how these laws differ.

Know the difference between gift tax law and estate tax law. The two aspects of this unified tax code have a relationship but are regulated separately.

- Gift tax law applies to property and assets given from one living person to another.

- Estate tax law applies to property and assets left to heirs upon death.

Understand the relationship between gift tax and estate tax. While these are not the same thing, they are part of what is called the “unified federal gift and estate tax,” because laws governing one affects the other.

- Estate taxes are cumulative over the lifetime of the gift giver. Any taxable money you gift an heir during your lifetime will count toward the estate that you leave them upon your death.

- For example, if you give your child $200,000 each year for 10 years, and upon death leave them $5 million, your total gift will have a value of $7 million for tax purposes.

Part 2 Gaining Exemption

Know the exemption rate. The exemption rate refers to the amount or value of property or assets that one person can give without being taxed. Exemption rates vary by year due to inflation, and are announced by the IRS before the start of each calendar year.

- The annual gift tax exclusion amount is $15,000 for 2019. In other words, you can give $15,000 or $15,000 worth of property to as many people as you want in a year’s time, without needing to file a gift tax return in order to report the gift to the IRS.

- Federal estate tax exemptions, or the amount or value of property that one person can leave to their heirs without being taxed, is $11.4 million in 2019. That means if a person leaves more than $11.4 million in property or other assets to their heirs, it will be taxed at a rate of 40%.

Take advantage of the exemption rate. Knowing the annual rate can help you make smart gifts that will not be taxed.

- You can give as many gifts of $15,000 or less annually as you want to as many people as you want. If you have 4 children, you can give all 4 $15,000 or the equivalent in property or assets every Christmas. If you have 8 grandchildren, they can also get $15,000 each.

- Because spouses file gift tax returns separately, 2 spouses can each make $15,000 worth of gifts to however many people they want in a year, and these gifts are excluded.

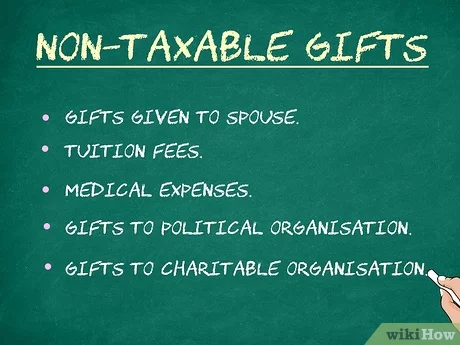

Understand what gifts are not considered taxable gifts. The federal government does not tax certain gifts, so these are good choices if you want to make a gift that is exempt from tax laws. Some exempt gifts include:

- Gifts given to your spouse. You may transfer an unlimited amount of property to your spouse without paying gift taxes, as long as they are a United States citizen.

- Those used for tuition. Money or property used to pay for tuition at a qualified college or university is exempt from federal gift tax, provided you pay it directly to the educational institution. So, instead of just handing over that $15,000 as a gift to your child, pay for a year of college instead. To determine if a specific college or university is a qualified institution for federal gift tax purposes, consult a certified public accountant or tax attorney. In general, accredited universities qualify.

- Those used to pay off medical expenses. Money or property used to pay someone else’s medical expenses is exempt from the federal gift tax. To qualify, it must be paid directly to the health care provider.

- Gifts given to political organizations for their own use. To determine if a gift you have made to a political organization is a non-taxable gift, consult a certified public accountant or tax attorney.

- Those given to qualified charitable organizations. To determine if a gift you have made to a charitable organization is a non-taxable gift, consult a certified public accountant or tax attorney.

Part 3 Structuring Your Gift to Avoid Taxes

Give the gift jointly with your spouse. Since you and your spouse each have an annual gift tax exemption, you can give a gift of twice as much to any one person in a year, by giving the gift jointly with your spouse.

- For example, in 2019, you and your spouse each have a $15,000 per person exemption. You may therefore gift $15,000 to your son and your spouse may gift $15,000 to your son, for a total of $30,000.

- If your spouse is a nonresident alien, you may not be able to avoid incurring a gift tax by splitting your gifts. Consult the current IRS rules to determine whether you and your spouse are eligible for this exemption.

Give the gift to spouses. Just as spouses may double the size of a gift by giving it together, so may you double the size of a gift by giving it to a married couple.

- For example, in 2019 you may gift $15,000 to your son and $15,000 to your son’s wife, for a total of $30,000, without paying gift tax.

- Combine this loophole with the previous one, and if you are married, you and your spouse can gift your son and his spouse a total of $60,000 without paying gift tax.

Use your lifetime gift tax exemption. Because of the relationship between the estate tax code and the gift tax code, you can essentially defer payment of gift taxes if your gifts don’t exceed the lifetime limit.

- An individual can make up to $11.4 million in reportable gifts, in excess of the annual exclusion amount, and not have to pay gift tax. Instead, they may use the individual lifetime credit to avoid paying the tax. Only after the total of all reportable gifts exceeds $11.4 million in a lifetime is gift tax owed.

- For example, if you gift your son $16,000 a year for 5 years, $1,000 a year of those gifts will be taxable, for a total taxable gift amount of $5,000. While you will still be required to file a gift tax return each of the 5 years, you may use $1,000 of your lifetime exemption each year, to exempt that $1,000 from gift tax. At the end of the 5 years, you will have used $5,000 of your $11.4 million lifetime exemption.

Offer gifts that are exempt from the gift tax. Some types of gifts are not subject to the gift tax and also do not cut into your lifetime exemption. For example, you can make a contribution to 529 college savings plan of up to 5 times the annual gift exclusion amount (which is $15,000 in 2019). This contribution will not incur any gift tax or use any of your lifetime exemption.

- For instance, you could contribute as much as $75,000 to a 529 plan in a lump sum, or you and your spouse together could contribute up to $150,000.

- The IRS would treat a gift like this as though it had been made in increments over 5 years. You would need to report the gift on your tax return each year over the next 5 years.

Set up a trust. Some types of trusts can help you to avoid paying gift taxes. Some trusts commonly used for this purpose include:

- Grantor Retained Annuity Trust, or GRAT. This is a trust created for a set number of years, called a term. At the end of the term, someone such as a child or grandchild, gets the trust assets. This person is called the remainderman, because they get the remainder of the trust assets. During the term of the trust, the grantor receives annuity payments from the trust. Because the remainder interest is calculated at the time the trust is created, and not at the time the trust is terminated, the gifted amount will actually be much higher than the amount on which you must pay taxes. So, the trust assets can be transferred to the remainderman free of gift tax, or at a discounted value.

- For example, if you put $1,000,000 into a GRAT for one year, take two $500,000 annuity payments, and assume a 5 percent simple interest rate, the amount passing to the remainderman will be only the interest earned, which you assume will be 5 percent of $1,000,000, or $50,000. If, however, the GRAT actually earns 8 percent interest, or $80,000, the remainderman will receive $30,000 more than you originally calculated, and it will be a tax-free gift.

- Personal Residence Trust. This a trust to which a person titles their personal residence during their lifetime. A provision of the trust provides that the beneficiaries must wait a certain number of years before receiving the house. Just as with a GRAT, the value of the gift is calculated at the time the trust is created, not at the time it is terminated. Because the house may appreciate before your beneficiaries receive it, the appreciated value is transferred free of gift taxes.

- For example, if your home is valued at $50,000 when you put it into a 5-year Personal Residence Trust, the amount you will use to calculate gift tax is $50,000. Over time, the value of the real estate will increase, or appreciate, and in 5 years, when the trust terminates, if the home is worth $70,000, the appreciated value, or $20,000 will pass to the beneficiaries gift-tax free.

- Dynasty Trust. Dynasty trusts are similar to GRATs, and reduce or eliminate gift taxes the same way, calculating the value of the gift at the time the trust is created and not at the time it is terminated, so the value of any appreciation is not subject to gift tax. A Dynasty trust differs in that it is set up to last through several generations, distributing interest and income to several successive generations, avoiding gift and estate taxes throughout.

- For example, you may set up a Dynasty trust, with $5,000,000, take annuity payments of $50,000 a year for the rest of your life, distribute any interest earned to your children and grandchildren for their lifetimes, and terminate the trust during your great grandchildren’s lifetimes, leaving them the remaining balance.

Transfer property for no less than fair market value. When property is transferred for fair market value, it is exempt from gift taxes, as it is considered a sale, and not a gift.

- Fair market value is defined as the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell, and both having reasonable knowledge of the relevant facts.[13] Relevant facts include whether the item works properly, how old it is, and whether there is any damage to it.

- For example, if your car is valued at $10,000, and you give it to your child in exchange for anything valued at $10,000 or more, such as cash or a vehicle of theirs, you have sold the car to your child, not gifted it. However, if you give the car to your child in exchange for $5,000 in cash, you have gifted the difference between the $10,000 worth of property you gave and the $5,000 in cash you received, for a total of a $5,000 gift to your child.

Give the gift as an inheritance after your death. In 2019, federal estate taxes are due only on estates worth upwards of $11.4 million.

- If federal estate taxes will not be due on your estate, leaving the property as an inheritance may be cheaper than giving it as a gift. State inheritance taxes generally have a much higher exemption than do federal gift taxes.

Conclusion

The gift tax is something most people don’t know about, which means they aren’t taking the necessary steps to avoid paying it. If you want to meet your financial goals with your family and future generations, learn about how to avoid gift tax.