How to Remove Inquiries From Credit Report – Because inquiries on your credit report can cause your credit score to drop a bit, you might be inclined to remove them. However, hard inquiries—those that are made because you applied for more credit—can not be removed unless they are inaccurate or fraudulent.

Since hard inquiries have only a small effect on your credit score and they go away after two years, you shouldn’t waste your time trying to get them taken off your report. The wiser action is to limit the number of credit applications you make over a short period of time

Table of Contents

What Is a Credit Inquiry?

A credit inquiry takes place when a bank, lender, or other credit-issuing institution views your credit report before offering you a loan or credit card.

There are other instances where a credit inquiry may also be used, which can include:

- A landlord or property management company checking your credit before approving you for an apartment lease

- A cell phone company inquiring about your credit before approving you for a contract

- A potential employer who wants to make sure your credit is in favorable standing before offering you a job

Hot Tip:While some situations will require that you actually apply for a product or service before they can check your credit, there are other instances where you don’t have to give your approval for a credit check.Advertisement

Different Types of Credit Inquiries

There are different types of credit inquiries that can take place on your credit report, including hard credit inquiries and soft credit inquiries. A hard credit inquiry can be a primary component of the underwriting process for all types of credit.

Soft credit inquiries, however, are often used more for marketing purposes — not just during a loan or credit approval process. It’s important to understand the differences between hard and soft credit inquiries because some inquiries can impact your credit report and credit score.

Hard Credit Inquiries

A hard credit inquiry (sometimes referred to as a “hard pull”) takes place when a company or entity has a legitimate business reason to look into your credit. In this case, the lender or creditor is seeking information about whether or not you will be reliable in paying the money back.

Your credit report will provide the lender or creditor with a “report card” of sorts in terms of your payback history, as well as other information such as how much credit you already have and what type of credit you carry (mortgages, auto loans, and/or credit card balances).

There are a number of lenders and creditors that will typically use hard credit inquiries. These can include:

- Mortgage companies

- Auto financing firms

- Student loan companies

- Lenders (personal and business)

- Credit card companies

When conducting a hard credit inquiry, the information that the lender or creditor has access to via your credit report can include the following:

- The number of accounts you’ve recently opened

- The proportion of accounts that you’ve opened recently (as opposed to longer-standing accounts)

- The number of recent credit inquiries that you have had

- The time that elapsed since any past credit inquiries

Soft Credit Inquiries

A soft credit inquiry may be requested for a number of different reasons. One way that creditors often use soft inquiries is for marketing to potential customers.

For example, a credit card company may want to send an offer to a list of people who meet specific credit-related characteristics, like having a credit score above a certain threshold.

Credit aggregating services may also use soft credit inquiries to help borrowers find a loan. These platforms will typically require information about a potential borrower, such as their Social Security number.

There are many reasons why a creditor or lender may conduct a soft credit pull:

- Credit card companies verifying a pre-approval offer to customers

- A company checking into your background as a new employee

- A landlord or property management company checking into an application you have made for an apartment rental

- Financial companies (such as banks, credit unions, or brokerage firms) verifying your identity

- Car rental agencies where you may be leasing a vehicle

- Utility, phone, and internet companies that are considering you as a new customer

In addition, your current creditors may also conduct a soft credit inquiry if you are applying for additional services from them, such as a new loan, or even an increase in a current line of credit.

You can also check your credit report and credit score, which counts as a soft credit inquiry as well. There are several ways to check your credit report and score for free, such as going through Credit Karma or Credit Sesame.

Once each year, consumers are allowed to receive their credit report for free from all 3 of the big credit bureaus: Equifax, Experian, and TransUnion. You can access this free credit report by going to AnnualCreditReport.com.

Hot Tip:Unlike a hard credit inquiry that requires your authorization, a soft credit inquiry can take place without your permission. Even though a soft inquiry will be noted in your credit report, these types of inquiries will not negatively affect your credit score.

A Comparison of Hard Versus Soft Credit Inquiries

While creditors and other entities can check your credit report and score through either a hard or a soft credit inquiry, there are some key differences between these types of credit “pulls.”

First, different information may be shown in a hard versus soft credit inquiry. For example, a creditor or other entity performing a soft credit pull for promotional or marketing purposes will only be able to view a limited report. To obtain your full credit file, they’d have to use a hard credit inquiry.

Also, hard credit inquiries can have a negative effect on your credit by lowering your credit score. Even though soft inquiries are still noted on your credit report, these cannot lower your credit score — nor do they show up as a negative on your credit report.

Finally, for a lender or a creditor to conduct a hard inquiry, you must first have granted them permission to do so. Therefore, if you discover a hard credit inquiry was conducted without your knowledge or permission, you can often dispute it.

Why Credit Inquiries Could Hurt Your Credit Score

The type of credit inquiries you have could impact your credit report and credit score. For example, a hard credit inquiry could reflect negatively, and may even bring your overall credit score down.

This is because those who have recently applied for a new loan and/or additional credit can be viewed as a more risky borrower. This is particularly the case if you already carry large loans or credit balances.

Can You Remove Inquiries From Your Credit Report?

When compared to other items that impact your credit score — such as late or missed payments — credit inquiries are the least important item to remove. However, there can still be some very good reasons for disputing and ultimately removing such an inquiry.

As an example, if you don’t recognize a credit inquiry on your credit report, you could have been a victim of identity theft. In this case, it would be important to get the information removed, especially if it’s having a negative impact on your credit score.

Before you do so, though, remember that only hard credit inquiries conducted without your permission can be disputed. Therefore, if you willingly applied for a loan or credit and the corresponding inquiry has shown up on your report, you likely won’t be able to have that particular credit inquiry removed.

If an item can be disputed, there are a couple of ways you can proceed. One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry (or inquiries) were not authorized, and then request that those inquiries be removed.

You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up. Because not all lenders and creditors report all information to all 3 of the bureaus, it’s possible that a particular inquiry will only show up on 1 or 2 of your credit reports.

In any case, make sure to keep copies of any correspondence and supporting documents that you send to the creditor(s) and/or credit bureau(s).

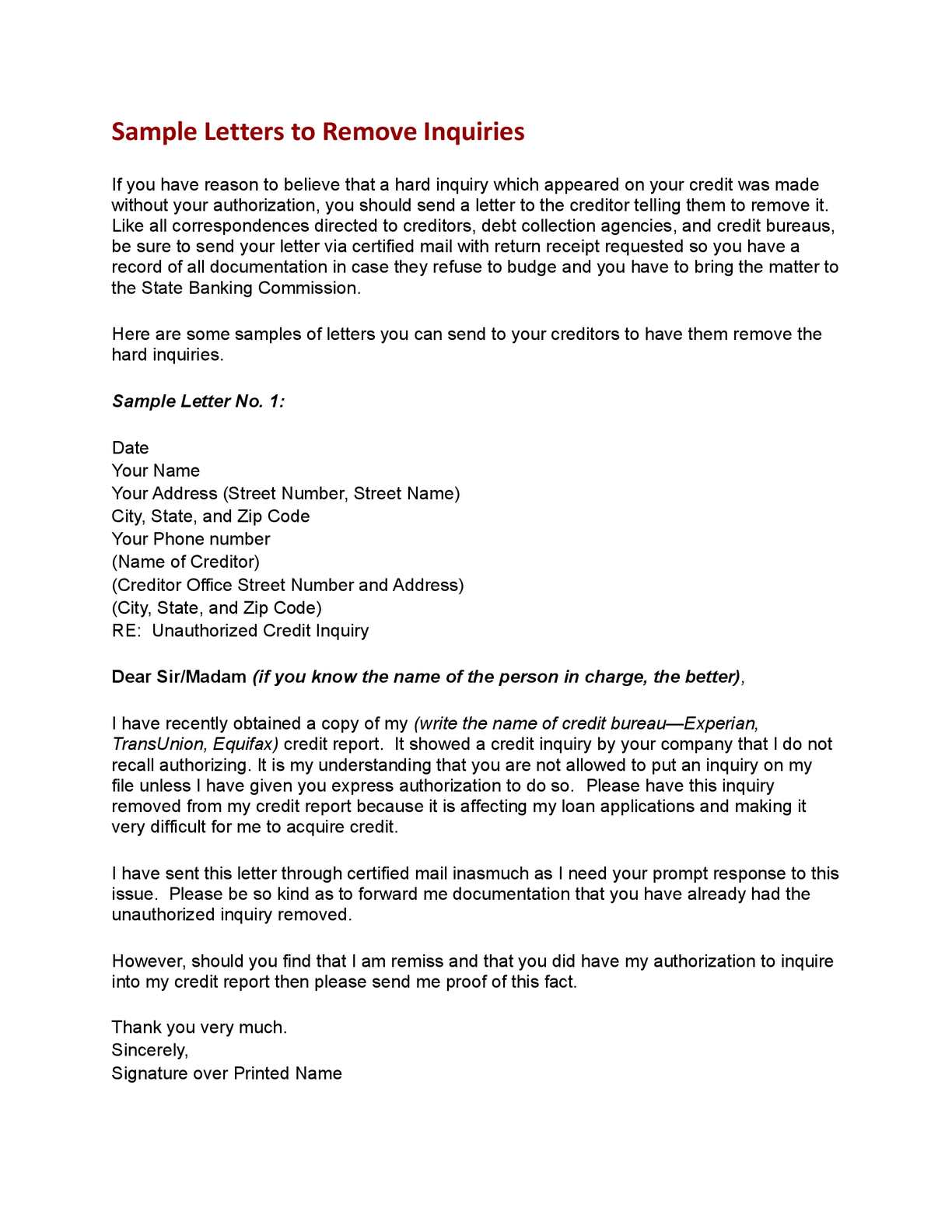

Credit Removal Letter Template

When submitting a dispute for an inquiry on your credit report, you’ll need to include some specific information. The following credit inquiry removal letter template will help you organize your correspondence to a specific creditor:

<Your Name>

<Your Address>

<Your Phone Number>

<Name and Address of the Creditor>

<Date>

Re: Unauthorized Credit Inquiry

Dear Sir / Madam (or the name of a specific individual, if you know it):

I recently obtained a copy of my credit report from <name of the credit bureau — Equifax, Experian, and/or TransUnion>. It indicated that a credit inquiry was made by your company. However, this inquiry was not authorized by me. Therefore, I am writing to dispute this inquiry and have it removed from my credit report.

Please have this inquiry removed from my credit report, as it is having a negative effect on my loan applications and my acquisition of credit.

I have sent this letter via certified mail as it requires your prompt attention and response. Please forward any documentation that you may have in regards to the removal of this credit inquiry.

Conversely, should you find that I am remiss and my authorization was in fact obtained for making this credit inquiry, I would appreciate any such documentation of that as well.

Thank you for your prompt assistance.

Sincerely,

<Your Name>

In addition to sending a letter to the lender or creditor, it can be beneficial if you also include a copy of the page on your credit report where the incorrect/unauthorized inquiry shows up. This can serve as additional proof for your dispute case.

Disputing Inaccurate Hard Inquiries Yourself

It’s important to check your credit reports regularly for accuracy. If, while doing this, you’ve noticed a hard inquiry on your credit report that you believe is the result of identity theft, you can file a dispute with each of the three national credit reporting agencies and petition to have them update the inaccurate information.

The first step is to review your Experian credit report through our Dispute Center and verify your information. Next, confirm that the inquiry was not a result of identity theft.

There may be situations where you don’t recognize the name of a company that checked your credit or you don’t remember applying for a loan with a company you do recognize. Here are a few scenarios when inquiries you don’t recognize may be legitimate:

- You may have solicited a home repair and provided your Social Security number to the vendor, and they may have taken that as an authorization to check your credit for financing reasons.

- If you sought financing when you were shopping for a car, a dealership may have sent your loan application to multiple lenders to find you the most favorable interest rates. Multiple inquiries with company names that you don’t recognize could show up from that time period. If they all fell within a window of a few weeks, they will be considered rate shopping and will only count as a single inquiry in credit score calculations.

- The same scenario could happen with mortgage applications. For example, you may have solicited mortgage rates online, where a website sent your application to multiple lenders to find you the best rate. Also, you may have worked with mortgage servicer who sent your application to a lender, and that lender may have checked your credit on behalf of the mortgage servicer.

- Another example when a hard inquiry may look like fraud involves store credit cards. National retail stores may use financial services companies for their store cards, and when inquiries are made, they may show up with company names you don’t recognize. For example, if you apply for credit at Kay Jewelers, you may see an inquiry from “Comenity Bank/Kay” on your credit report.

If you don’t recognize the company name that performed the hard inquiry, contact the company for more information. When you check your credit report through the Experian Dispute Center, the hard inquiry will be accompanied by the company name and typically the mailing address and a phone number.

If you have verified that the hard inquiry is due to identity theft, then the dispute would be handled over the phone with Experian specialists. You can visit our Dispute Center to find out support options. There is no charge to use this service.

Once you submit the request, you can track your progress through the Dispute Center. Generally, the dispute process will be done within 30 days. If the inquiry was found to be valid, it will not be removed from your credit report. However, if the investigation shows the inquiry was a result of identity theft, it will be removed from your report.

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score (you can check your FICO® Score☉ for free with Experian), and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

Conclusion

While a single hard inquiry, also known as a “hard pull,” is unlikely to impact your eligibility for new credit products such as a new credit card, it can affect your credit scores for up to two years.