How to Do Payroll for Employees – Do you have a small business? Does it consist of a single employee or a few employees? If so, you will most likely need to do your payroll yourself. Doing your own payroll can be challenging and time consuming. It can also be nerve- wracking when you don’t know how to, or have never done it before.

This guide will help you understand exactly what payroll is and how to do it yourself – the basics only!

Table of Contents

Method 1

How to process payroll

Step 1: Establish your employer identification number.

The first step in processing payroll is to establish your EIN and your state and local tax IDs. The government uses these identifications to track your business’s payroll taxes and ensure you’re meeting requirements.

If you don’t know your EIN or you don’t have one, you can visit the IRS website to set one up. For your state and local tax IDs, you’ll have to go through your state and municipality. [Looking to find the best payroll system reviews for your small business? We can help!]

Step 2: Collect relevant employee tax information.

Before you start processing payroll, your employees will have to fill out various tax forms so you can account for allowances and other tax details. These forms include the W-4 and I-9 (if it is a new employee). There are various state and local forms you will have to provide, but these will depend on where your business is operating.

Before processing an employee’s first paycheck from your company, you should also have these documents on hand:

- Job application: Even if the employee never filled out a formal application, having this document on file ensures that all key payroll information is in one place.

- Deductions: The employee may participate in company benefits, such as health insurance, a health savings account or a retirement savings plan. Proper payroll processing ensures that the correct amounts for these benefits are withheld each pay period.

- Wage garnishments: You may be required by law to garnish your employees’ wages if they owe money, such as IRS payments or child support. Wage garnishments are court-ordered; ensure you have the proper documentation on hand and in your records.

Step 3: Choose a payroll schedule.

Once you have the relevant tax and legal information to set up payroll, you can choose a schedule that works best for your business. There are four main schedules: monthly, semimonthly, biweekly and weekly. It’s important to understand each plan before deciding which is best for your business. Once you choose a schedule, set up a calendar with paydays, and make note of the days when you’ll have to process payroll for your workers to get their money on that defined day.

Build in important quarterly tax dates, holidays and annual tax filing dates. Keep in mind that you’ll have to do this at the start of every year. You’ll also want to establish the preferred delivery method for each employee. For example, many businesses allow employees to choose between paper check and direct deposit.

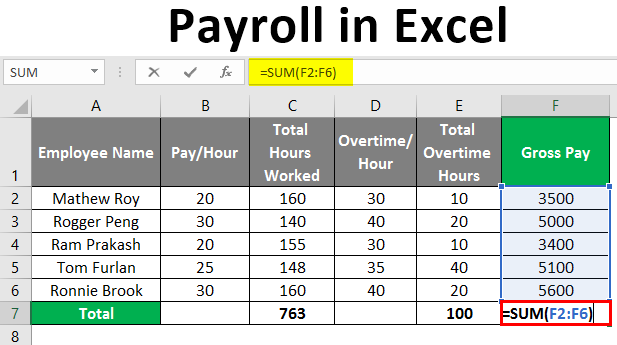

Step 4: Calculate gross pay.

Now that you’ve set a payroll schedule, you can start processing your first payroll. To do this, you must calculate each employee’s gross pay, which is the total number of hours an employee works in a given pay period multiplied by their hourly rate.

Start by calculating the number of hours an employee has worked in a given pay period, and take note of overtime hours. The extra time has to be paid out at a higher rate consistent with federal law. If an hourly worker puts in more than 40 hours per week, you’ll have to pay time and a half, or an employee’s hourly wage plus half that wage.

Here’s an example of a gross-pay calculation:

- Worker A has worked 50 hours for your weekly pay period and earns $10 per hour.

- 40 hours x $10/hour = $400

- 10 hours x $15/hour (time and a half) = $150

- Gross pay = $550

Step 5: Determine each employee’s deductions.

Gather information from your workers’ W-4s, federal and state requirements, insurance requirements, and benefits requirements to determine each employee’s deductions. This can get complicated; each state collects different taxes from small businesses, so you’ll have to research your state’s policies before you complete this step. Here are some examples of common requirements:

- Federal taxes

- Social Security

- State taxes

- Local taxes

- Medicare

- 401(k) contributions

- Workers’ compensation contributions

- Other benefits

Step 6: Calculate net pay, and pay your employees.

Subtract each employee’s deductions from their gross pay. The amount left over is the employee’s net pay, or take-home pay. This is the amount you’ll pay each employee. You’ll have to hold the deductions and pay them with your payroll taxes each month or quarter, depending on the schedule you establish.

Once you’ve established each employee’s net pay, you can pay them on their scheduled payday. Here are some examples of ways to pay your employees:

- Paper checks mailed to their home or distributed at the office

- Direct deposit to their bank accounts

- Prepaid cards that are loaded with their take-home pay

- Mobile wallet into which you can deposit your employees’ pay

- Cash (although this method requires more detailed recordkeeping and might be a safety concern)

Step 7: Keep payroll records, and make any necessary corrections.

As you process payroll, it’s important to keep records of your transactions for tax and compliance purposes. If an employee disputes payment or the IRS needs some kind of documentation down the line, you need to have records at the ready. Especially in the case of an employee disputing a paycheck, it’s important to maintain records, including year-to-date payment, so you can sort out any issues that arise.

Step 8: Be mindful of ongoing considerations.

Keep in mind that you have to file your business’s taxes quarterly and annually. It’s important to consult an accountant to ensure you understand how your payroll taxes fit into this aspect of your operations. You’ll also have to report any new hires to the IRS. When you work with a payroll solution or an accountant, this usually isn’t your responsibility.

Method 2

How to process payroll yourself

Summary: Doing your company’s payroll on your own costs less, but is time consuming and prone to errors.

If you’re tax savvy, you may be able to take on a DIY approach to paying your employees. But given all the payroll mistakes you can make (and nasty fines you can incur as a result), make sure you’re completely comfortable with everything you need to do before you dive in.

To get started:

Step 1: Have all employees complete a W-4 form. To get paid, employees need to complete Form W-4 to document their filing status and keep track of personal allowances. The more allowances or dependents workers have, the less payroll taxes are taken out of their paychecks each pay period. For each new employee you hire, you need to file a new hire report. Note that there is a new version of the Form W-4 for 2020, so this is the form you should have new hires fill out starting January 1, 2020.

Step 2: Find or sign up for Employer Identification Numbers. Before you do payroll yourself, make sure you have your Employer Identification Number (EIN) ready. An EIN is kind of like an SSN for your business and is used by the IRS to identify a business entity and anyone else who pays employees. If you don’t have an EIN, you can apply for one here on the IRS site. You may also need to get a state EIN number; check your state’s employer resources for more details.

Step 3: Choose your payroll schedule. After you register for your Employer Identification Numbers, get insured (don’t forget workers’ compensation), and display workplace posters, you need to add three important dates to your calendar: employee pay dates, tax payment due dates, and tax filing deadlines (read more about basic labor laws here).

Step 4: Calculate and withhold income taxes. When it comes time to pay your employees, you need to determine which federal and state taxes to withhold from your employees’ pay by using the IRS Withholding Calculator and your state’s resource or a reliable paycheck calculator. You must also keep track of both the employee and employer portion of taxes as you go.

Step 5: Pay payroll taxes. When it’s time to pay taxes, you need to submit your federal, state, and local tax deposits, as applicable (usually on a monthly basis).

Step 6: File tax forms & employee W-2s. Finally, be sure to send in your employer federal tax return (usually each quarter) and any state or local returns, as applicable. And last but not least, don’t forget about preparing your annual filings and W-2s at the end of the year.

Note: This is not an exhaustive list of your responsibilities as an employer. For advice specific to your business, be sure to go over federal and state requirements or consult with a professional.

How to process payroll with a payroll service:

Just like with the DIY option above, you need to have all your employees complete a Form W-4 and find or register for Employer Identification Numbers.

From there:

Step 1: Choose a full-service payroll provider. If you’re not sure how to do payroll yourself, use payroll software that reduces the risk of errors or fines. Many payroll processing services, like Square Payroll, handle your payroll taxes, filings, new hire reporting for you, and allow you to complete payroll online. Sign up takes minutes — so you can quickly start doing your own payroll the same day you sign up.

Step 2: Add your employees. You need to set up your employees before you process their payroll. Adding employees you’re paying for the first time is generally quicker; if you’re switching to a new payroll provider, then you also need to add your current employees’ year-to-date payroll information. Either way, you generally need to enter employee names, addresses, Social Security numbers, and tax withholding information. If you’re using Square Payroll and would like to pay employees using direct deposit, you can just enter your employees’ names and email addresses so they can enter their personal information themselves.

Step 3: Track hours worked and import them. The U.S. Department of Labor requires employers to keep track of wage records such as timecards for up to two years. Certain states may have longer retention requirements; be sure to check the specific requirements in your state. You can track time using your Square Point of Sale and import the timecards to payroll.

Step 4: Process your first payroll run. Click Send and you’re done!

Step 5: Keep track of your tax payments and filings. The IRS requires tax forms to be kept for three years. Certain states may have longer retention requirements; be sure to check the specific requirements in your state. With Square Payroll, you can find copies of your tax filings in your dashboard.

Alternative 2: Hire an accountant

Summary: Hiring an accountant is the most expensive option, but it’s reliable.

If you don’t want to learn how to do payroll yourself for your company or use a payroll service, consider hiring an accountant. A good accountant can process your payroll and make sure your tax payments and filings are taken care of. Check out these five tips that can help you find your ideal accountant.

Conclusion

Payroll is the method of paying employees regularly. Payroll services are usually done for an employer by a third-party who specializes in this kind of work. This service is very useful especially if the employer has more than five employees. The process of payroll can be very stressful, even for those who are experts in it. There are many things that must be taken into consideration when doing the payroll, because the penalties for mistakes are really high.