Did you ask yourself: “How to do booking for a small business? ” or “How to book keep your business?”. You are looking for some free templates or some free examples of how to do bookkeeping for a small business.

No matter the size of your business, chances are you’ll need to consider booking your financial processes and accounts at some point. While the majority of organizations and businesses handle their funds via a bank, Here is quick step to get you started with book kepping:

Table of Contents

Account Payable

Setting Up Your Accounts Payable

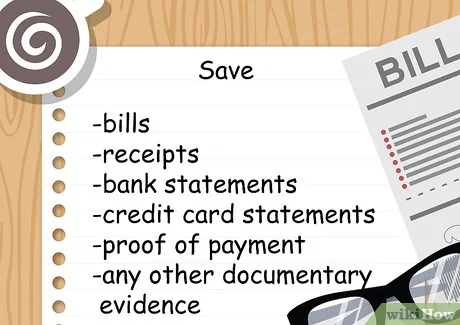

Save proof of business expenses.Accounts payable is the amount of money you owe other people for business expenses. If you buy inventory or supplies, then you’ll need to collect proof of the expense. You’ll also need this information later at tax time. Save the following:[2]

bills

receipts

bank statements

credit card statements

proof of payment

any other documentary evidence

spreadsheet or ledger

Set up a spreadsheet or ledger. You’ll need create an electronic spreadsheet or ledger on a piece of paper. If you don’t want to do this yourself, there is bookkeeping software you can purchase that will make bookkeeping easy.

Think about moving to an automated system when you’re receiving more than two bills a day or your expenses are increasing rapidly.

Keep a Pulse on Your Cash Flow

When it comes to small business accounting tips, education is everything. The more you understand the numbers in front of you, the greater your odds are at managing them well.

As you perform weekly and monthly financial reviews, consider producing a cash flow statement. These statements give you a broader understanding of cash movement within (and outside) of your company. A cash flow statement essentially monitors income direction. It also includes the element of time, enabling you to visualize payment cycles and seasonal expenses.

Cash flow statements can give you the knowledge you need to anticipate expenses and more appropriately allocate income. They are also useful when building financial trajectories.

You don’t have to generate a cash flow statement, however, in order to understand monetary motion. Simply using the right technology can help you get a holistic vision of how cash is functioning in your business model.

columns for necessary information

Create columns for necessary information. You’ll include the following information on your spreadsheet or ledger, so create a column for each:

supplier’s name

account number

type of expense (e.g., office supplies, professional services, etc.)

date you received the invoice

amount you owe

daily information

Post information daily. It’s important not to overlook accounts payable and forget to include them on your spreadsheet. Get in the habit of posting information daily.

If you have few expenses, then you might want to post only weekly or monthly, but it’s key that you remember to develop a routine.

Pay Bills

Pay your bills in a timely fashion.

Remember to pay bills frequently—on a weekly basis is ideal. Don’t wait until the due date. Instead, give yourself a few days in advance of the deadline.

Paying bills early is a good way to maintain effective relations with your vendors.

However, if you’ve been hired by a business to work as a bookkeeper, then paying on time is a necessity for maintaining your job.

Account Receivable

Setting Up Your Accounts ReceivableCreate an invoice template.

You want your invoice to be clear so that clients will pay as quickly as possible. Include the following information on your invoice:

- your business contact information

- your business logo (if applicable)

- clear payment terms, such as “payment is due in 30 days of invoice date”

- detail about the specifics of your service

- hours worked

- the name a check should be made out to (particularly important if you operate under a fictitious business name)

Pay Close Attention to Receivables

Getting paid is the most exciting part of running a business. Managing your receivables isn’t quite as much fun. When an invoice is issued, you record a receivable, meaning you log that a customer owes you money. By checking this listing you are able to easily see if a customer has an outstanding balance.

When the customer pays you, the amount should be applied to their invoice, and it should be marked as paid. However, when you are trying to keep up with a lot of orders, this is easier said than done. Customer deposits all too often are left to reconcile at a later date since there are never enough hours in the day. That means that when tax time comes around, you are left with a lot of customer deposits in your revenue account and a report of your receivables that don’t match.

The consequences here are that you waste hours updating your listing, you can overpay on your tax return, and you will have high debts. That is why you need to make it a point to keep track of your transactions as they happen. Apply your customer’s payments monthly — it can save you tons of time on invoicing (and money) in the long run.

Save Proof payment and documents

Save proof of payment and other documents.

Just as you document your expenses, also document your accounts receivable. Hold onto the following, and create electronic copies if possible:

invoices

cancelled checks

other proof of payment.

Create a ledger book

Create a spreadsheet or ledger.

You need something to enter your accounts receivable information onto. Choose a spreadsheet or a ledger book. Also consider using software. You can use the same software for accounts receivable that you use for accounts payable.

If you are receiving 5-10 invoices a week, you should consider automating the system.[5]

Columns for account receivable

accounts receivable information

accounts receivable information

accounts receivable information columns

Insert columns for accounts receivable information.

Set up columns for the following information on your spreadsheet or ledger:[6]

customer name

invoice date

invoice number

amount owed

due date

amount past due

date payment was received

Post information regularly

Post information to your ledgers regularly.

Get in the habit of staying on top of the amounts your customers owe you. You should post accounts receivable regularly, which will depend on the size of your business. The key is to get in a consistent habit so that you don’t forget.

If you’re receiving multiple invoices a day, then posting daily is a good idea.

However, if you have only a few big invoices a month, then you might want to post monthly or weekly.

Nevertheless, if you’re posting accounts payable daily, you should get in the habit of reviewing accounts receivable at the same time.

Late Payments

Follow up on late payments. A bookkeeper also needs to track down customers who haven’t paid in a timely fashion.<> You’ll need to send appropriate letters telling the client their bill is due.

If you find clients aren’t paying the business, you might want to talk with the owner about giving customers more options for making payment. For example, the business could accept credit cards.

Documenting Petty Cash

Establish the starting balance.

You can quickly lose track of where your petty cash has gone if you don’t keep accurate records. Accordingly, start with an initial balance. Make it small enough that your employees won’t feel tempted to steal from it but large enough that it can cover reasonable expenses.

Most small businesses can get by with $50-200 in petty cash.

Receipt

Require receipts. Keep careful records of what petty cash is spent on. Require your employees to provide receipts of all purchases made using petty cash.[9] Have a folder where you store receipts, and get in the habit of organizing receipts on a weekly basis.

Log

Create a log. You should also keep a log along with your receipts.[10] You need the log because not every purchase will have a receipt. On the log, record the amount taken from petty cash and what is was spent on. Enter the information immediately.

For example, if you took $20 out to buy new pens for the office, you should enter the information as soon as you remove the money from the petty cash box. If you have money left over, then record that you are returning money to the petty cash box.

Write a check to yourself

Replenish by writing a check to yourself. This is a good way to document cash transfers. You can keep a copy of the cancelled check that shows which account you transferred money from. Don’t just take cash from your own wallet and dump it in the petty cash box.

Petty Cash information

Enter petty cash information accurately on your balance sheet. Consider petty cash to be an asset on your financial statements.[11] Don’t neglect to accurately record it. Although the amounts may seem small, they can add up quickly for a small business.

Reconciling Your Accounts

- Keep ledgers for all financial accounts. You may have several business bank accounts. For example, small businesses usually have a checking account to pay bills and a savings account to save up money to pay self-employment tax.[12] You should also create a ledger or spreadsheet for each of your major accounts

- Keeping this ledger will allow you to monitor the current state of your business. You won’t have to wait for the monthly bank statement to see if your business is insolvent or thriving.

- Reconcile your books. You need to make sure that your monthly recording of expenses is the same that shows up on your bank records. This means analyzing your bank statement and your accounts to make sure the same transactions appear on each.

- Reconciliation is a good way to catch mistakes—yours or the bank’s. If the bank makes a mistake, you can contact them. Share whatever documentation you have (receipts, cancelled checks).

- You can also catch fraudulent activity with reconciliation. For example, an employee might have withdrawn money from the checking account without telling you.

- Perform reconciliation monthly.[13] If you wait too long, it will be harder to reconcile. Also, you won’t catch fraudulent transactions in a timely manner.

- Meet with the accountant. You may need to meet with the company’s accountant once a month to go over the books. The accountant can identify any recordings that are unclear or inaccurate, and you can talk about them.

Hiring Accountant or Book keeper

hire a book-keeper or accountant

If there’s one area you shouldn’t skimp on professional help, it’s with your finances. A good accountant will save you more money than they cost. If they can’t or they’re not proactive enough, fire them and find a new one through personal recommendation. Professional codes of conduct make it relatively easy to switch accountants.

If you are struggling to keep up-to-date with paperwork, consider hiring a bookkeeper to get your books in order on a regular basis. Not only will they reduce your accountancy bill, but they will potentially help you earn more money.

If you charge £40 an hour and can pay a book-keeper £20 an hour, shouldn’t you be out there working while they get your accounts straight for you? And remember an expert will probably be able to do it in half the time it would take you.

You should be able to find a local book-keeper without too much trouble by asking other business owners for a recommendation. Alternatively, the Institute of Certified Book-keepers has thousands of qualified bookkeepers on its books, and can put you in touch with one of its’ members near you.

Put time aside to do your book-keeping regularly

When you are starting out it’s tempting to leave your book-keeping until the evenings. But if you’re tired simple tasks will take longer, and you’re more likely to make mistakes.

If you need to tackle a job like this outside of working hours when you could be earning money, then consider getting up early one morning, or doing it on a Saturday morning. Make it a regular day to form a habit.

You may well find that using a suitable accounts software package takes much of the pain away. ByteStart’s Guide to Choosing the Right Online Accounts Software for Your Business will help you to understand what you should look for in an online accounts package.

Conclusion

Whether you’re tackling your small business finances on your own or working with the services of an experienced bookkeeper, there are many useful tricks of the trade to glean. With these tips on your side, you’ll save time by more accurately tracking receipts and invoices, learn to avoid costly errors, and gain valuable insight into how your business is performing.