How Do You Start a Financial Plan for a Startup?- You have a business idea and strong passion for your startup, so you try to work on it as much as you can. But you realize that the dream alone is not going to be enough. You need a financial plan, or a startup plan, if you want to turn the business into a reality.

Have you ever wondered how to start a financial plan for a business? You’re not alone. There are thousands of books, online resources and blog posts all containing different advice on how to make a business plan. I’ve tried a lot of strategies in the past. This has led me to create my own list of go-to resources for making a startup or financial plan.

Table of Contents

What is a financial plan?

A financial plan is simply an overview of your current business financials and projections for growth. Think of any documents that represent your current monetary situation as a snapshot of the health of your business and the projections being your future expectations.

Why is a financial plan important for your business?

As said before, the financial plan is a snapshot of the current state of your business. The projections, inform your short and long-term financial goals and gives you a starting point for developing a strategy.

It helps you, as a business owner, set realistic expectations regarding the success of your business. You’re less likely to be surprised by your current financial state and more prepared to manage a crisis or incredible growth, simply because you know your financials inside and out.

And aside from helping you better manage your business, a thorough financial plan also makes you more attractive to investors. It makes you less of a risk and shows that you have a firm plan and track record in place to grow your business.

Components of a successful financial plan

All business plans, whether you’re just starting a business or building an expansion plan for an existing business, should include the following:

- Profit and loss statement

- Cash flow statement

- Balance sheet

- Sales forecast

- Personnel plan

- Business ratios and break-even analysis

Even if you’re in the very beginning stages, these financial statements can still work for you.

Why is financial planning important?

Before getting into the nitty-gritty of start-up financial plans, it’s important to consider why they’re necessary in the first place. Although virtually all companies will do some form of financial modelling, it’s especially important for start-ups, not least because it plays a key role in the financing process. Many financiers and investors will require a financial plan before they’ll consider funding your start-up, so on a purely practical level, a financial plan for a start-up business is important.

You should also consider the fact that it’s a necessary part of building a viable business model. Without a financial plan, you won’t be able to quantify your assumptions about the business. Plus, by building out different scenarios for the business (especially negative scenarios where things don’t go the way you expect), you’ll be much better able to deal with potential issues as they arise. Finally, financial plans can provide your company with benchmarks and targets to achieve, which is an effective way to measure the success of your company, particularly in the early years when you may not be making a profit.

How do I produce a start-up financial plan?

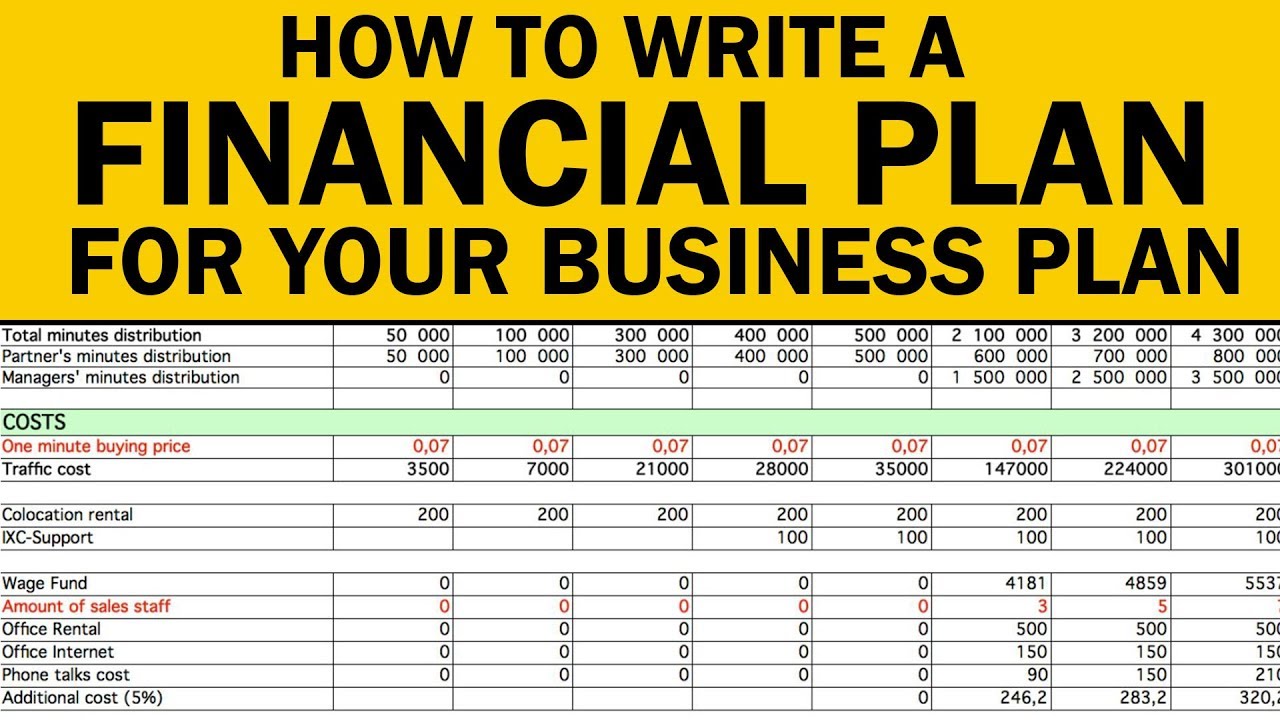

One of the key elements of financial planning is learning how to write a financial plan for a start-up business. When you create the plan, you’ll need to think about a broad range of issues, including your business’s gross/operating margins, profit potential, fixed/variable costs, break-even point, potential changes to cash flow, and profit durability. Some of the activities that you’ll need to undertake when producing a financial plan for a start-up business include:

- Sales projections

- Expense projections

- Balance sheet projections

- Income statement projections

- Cash flow projections

Of course, making a financial model requires a significant amount of effort. For a little more insight into generating financial projections for start-up businesses, take a look at our guide to financial projections.

Here are six steps to create your financial plan.

1. Review your strategic plan

Financial planning should start with your company’s strategic plan. You should think about what you want to accomplish at the start of a new year and ask yourself a series of questions:

- Do I need to expand?

- Do I need more equipment?

- Do I need to hire more staff?

- Do I need other new resources?

- How will my plan affect my cash flow?

- Will I need financing? If yes, how much?

Then, determine the financial impact in the next 12 months, including spending on major projects.

2. Develop financial projections

Create monthly financial projections by recording your anticipated income based on sales forecasts and anticipated expenses for labour, supplies , overhead, etc.. (Businesses with very tight cash flow may want to make weekly projections.) Now, plug in the costs for the projects you identified in the previous step.

For this job, you can use simple spreadsheet software or tools available in your accounting software. Don’t assume sales will convert to cash right away. Enter them as cash only when you expect to get paid based on prior experience.

Also prepare a projected income (profit and loss) statement and a balance sheet projection. It can be useful to include various scenarios—most likely, optimistic and pessimistic—for your projections to help you to anticipate the impacts of each one.

It may be a good idea to seek advice from your accountant when developing your financial projections. Be sure to go over the plan together, as it is you, and not your accountant, who will be seeking financing and who will be explaining the plan to your banker and investor.

3. Arrange financing

Use your financial projections to determine your financing needs. Approach your financial partners ahead of time to discuss your options. Well-prepared projections will help reassure bankers that your financial management is solid.

4. Plan for contingencies

What would you do if your finances suddenly deteriorated? It’s a good idea to have emergency sources of money before you need them. Possibilities include maintaining a cash reserve or keeping lots of room on your line of credit.

5. Monitor

Through the year, compare actual results with your projections to see if you’re on target or need to adjust. Monitoring helps you spot financial problems before they get out of hand.

6. Get help

If you lack expertise, consider hiring an expert to help you put together your financial plan.

Make financial planning a recurring part of your business

Your financial plan might feel overwhelming when you get started, but the truth is that this section of your business plan is absolutely essential to understand.

Even if you end up outsourcing your bookkeeping and regular financial analysis to an accounting firm, you—the business owner—should be able to read and understand these documents and make decisions based on what you learn from them. Using a business dashboard tool like LivePlan can help simplify this process, so you’re not wading through spreadsheets to input and alter every single detail.

If you create and present financial statements that all work together to tell the story of your business, and if you can answer questions about where your numbers are coming from, your chances of securing funding from investors or lenders are much higher.

Conclusion

Everyone knows how important it is to have a financial plan. But not everyone can afford a finance expert. Still, a good financial plan is a key to any successful business. If you are a young entrepreneur with a startup company you can learn from our example step by step.