How Do Stocks Work on Cash App-Do you want to know how stocks work on the cash application? You’ve come to the right place. Get all of your answers here including does cash app stocks work, how to buy stock with cash app, cash app stock price, and much more.

You’ve probably heard of the Cash App, but you might not know how it works. You might have wondered, “Does cash app trade stocks?” Or maybe you’re just curious about what kind of stocks you can invest in. Whatever your questions are, we’ll cover them here.

When you invest in a stock, you’re simply buying a part of the company whose stock it is. This segment of partial ownership is called a “share”.

The reason you buy a share is in the hope that the stock’s value/price will increase, which will allow you to sell it for a higher price than you bought it. This will make you a profit.

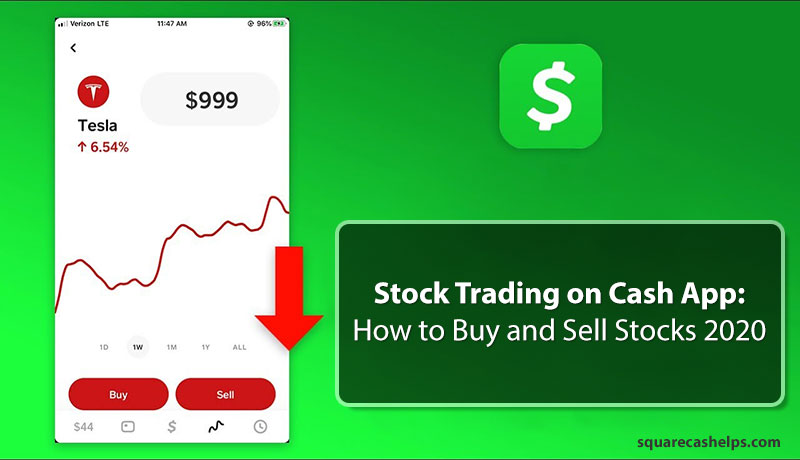

Cash App’s investing account is an excellent choice for beginner investors. Buying and selling stocks can be done within seconds, without any scary graphs.

But, this being said, if you’re a more experienced investor, then Cash App might not be so great for you. Let’s take a look at the pros and cons of Cash App stocks.

| Cash App Investing Review | |

|---|---|

| Pros | Stock optionsNo feesConvenience |

| Cons | AvailabilityLimited account types |

Cash App Investing’s standout qualities:

- Its ease of use for beginners. It holds your hand from buy to sell, and makes trading and investing a walk in the park!

- Once you’ve created your account you can immediately begin investing on Cash App for as little as $1. This is because Cash App allows for “fractional share” investing, meaning you don’t have to buy a whole share, but only a portion of it.¹ This makes it great for beginners, as your investment options aren’t limited by high share prices.

- Similarly, Cash App currently offers approximately 1,000 stocks, giving you a wide range of choice for investments.²

On the flip side, there are some drawbacks with Cash App, specifically for more experienced investors.

- Firstly, the different types of things you can actually invest in are fairly limited. Cash App only allows investment in stocks and Exchange-Traded Funds (ETFs). This can make it limited for experienced investors looking for other types of investment opportunities.²

- Similarly, you’re also limited with the types of accounts you can open. Cash App Investing only offers a taxable, standard brokerage account. Think again if you’re looking for Individual Retirement Accounts (IRAs) or joint accounts!

- As well as this, you’re only able to open a Cash App investing account if you’re a US resident. You also need to be 18 years old or older and you need to provide some personal details such as your social security number and home address.³

Table of Contents

How to invest with Cash App

When it comes to buying stocks, you can either transfer money from your bank account to your Cash App account, or use any amount of your current Cash App balance. According to its website, you can buy a stock by taking the following steps:

Steps for placing trades on Cash App

- Click the investing tab on your homescreen

- Tap the search bar and find a stock by entering a company name or ticker symbol

- Choose the company you want to invest in

- Choose a preset dollar amount or enter a custom amount

- Follow the prompts to verify your personal info

- Confirm transaction with your PIN or Touch ID

Best Cash App Stocks to Invest In

Apple Inc. (NASDAQ: AAPL)

Number of Hedge Fund Holders: 127

Apple Inc. (NASDAQ: AAPL) is ranked sixth on the list of 10 best cash app stocks to invest in, with Apple Pay being accepted as a digital payment option at 90% of retail outlets in the US. Apple Pay is the mobile payment platform used by 43.9 million people in the United States.

According to Bloomberg, Apple Inc. (NASDAQ: AAPL) is in collaboration with Affirm Holdings, Inc.’s (NASDAQ: AFRM) PayBright to launch a Buy Now, Pay Later (BNPL) service for Apple items in Canada beginning August 11.

In the third quarter of 2021, Apple Inc. (NASDAQ: AAPL) recorded an EPS of $1.30, beating estimates by $0.29. The company’s third-quarter revenue was $81.43 billion, increasing 36% year over year, beating revenue estimates by $8.09 billion. The company’s service segment, which includes Apple Pay, Apple TV+, and App Store, saw a 28% jump in revenue to $17.5 billion, up from $13.7 billion in the same period in 2020.

Ananda Baruah of Loop Capital maintained a Buy rating on Apple Inc. (NASDAQ: AAPL) on July 29 and increased the firm’s price target to $165 per share from $150. Shares of Apple Inc. (NASDAQ: AAPL) climbed 15% in the last three months.

At the end of the first quarter of 2021, 127 hedge funds out of the 866 tracked by Insider Monkey held stakes in Apple Inc. (NASDAQ: AAPL), worth roughly $130.9 billion.

Sea Limited (NYSE: SE)

Number of Hedge Fund Holders: 98

Singapore-based tech firm Sea Limited (NYSE: SE) operates SeaMoney, a digital financial solution that offers digital wallets, consumer and cash loans, and payment processing services available in Southeast Asia and Taiwan. Among products under SeaMoney are ShopeePay, AirPay, SPayLater, and SPinjam. Sea Limited (NYSE: SE) is ranked seventh on the list of 10 best cash app stocks to invest in.

SeaMoney’s mobile wallet total payment volume surpassed $3.4 billion in the first quarter of 2021, more than triple compared to the same quarter in 2020. Sea Limited’s (NYSE: SE) quarterly paying users for its mobile wallet services crossed 26.1 million. The company’s first-quarter revenue came in at $1.8 billion, an increase of 146.7% year over year.

Sea Limited (NYSE: SE) was given a Buy rating and a $325 price target by New Street analyst Jin Yoon on June 25. Shares of Sea Limited (NYSE: SE) jumped 6% in the last month.

At the end of the first quarter of 2021, 98 hedge funds in the database of Insider Monkey held stakes worth $10.4 billion in Sea Limited (NYSE: SE).

Just like Alphabet Inc. (NASDAQ: GOOGL), Apple Inc. (NASDAQ: AAPL), PayPal Holdings, Inc. (NASDAQ: PYPL) and Square, Inc. (NYSE: SQ), Sea Limited (NYSE: SE) is a good cash app stock to invest in according to market analysts.

Square, Inc. (NYSE: SQ)

Number of Hedge Fund Holders: 92

Digital payment solutions provider Square, Inc. (NYSE: SQ) is ranked eighth on the list of 10 best cash app stocks to invest in. The San Francisco-based fintech company provides e-commerce and banking financial solutions. Square, Inc. (NYSE: SQ) also operates the peer-to-peer money transfer app Cash App, launched in 2013. As of June 2021, Cash App provided access to over 40 million monthly transacting active customers to the stock market.

On August 3, Canaccord analyst Joseph Vafi maintained a Buy rating on Square, Inc. (NYSE: SQ) and increased the firm’s target to $310 per share from the previous $280, highlighting the Afterpay Limited (OTC: AFTPY) acquisition will accelerate Cash App’s buy now, pay later feature.

In the second quarter of 2021, Square, Inc.’s (NYSE: SQ) total net revenue grew 143% year over year to $4.68 billion. Meanwhile, Cash App generated a gross profit of $546 million, up 98% year over year. The company reported an EPS of $0.66, beating estimates by $0.35. The stock has gained 29% year to date.

Out of the hedge funds being tracked by Insider Monkey, Washington-based investment firm Fisher Asset Management is a leading shareholder in Square, Inc. (NYSE: SQ) 1,502,742 shares worth more than $366.3 million.

Just like Alphabet Inc. (NASDAQ: GOOGL), Apple Inc. (NASDAQ: AAPL), Sea Limited (NYSE: SE) and PayPal Holdings, Inc. (NASDAQ: PYPL), Square, Inc. (NYSE: SQ) is a good cash app stock to invest in according to market analysts.

Conclusion

Many people know about how to buy Bitcoin with the Cash App , but don’t know how to use Bitcoin or other cryptocurrencies to make money. However, Bitcoin and other cryptocurrencies aren’t the only ways you can make money with Bitcoin. If you hold Bitcoin, there are many ways you can make money. Today we’re going to tell you how you can make money by investing in Bitcoin and other cryptocurrencies.